Dealing with cryptocurrency is becoming an emerging way of earning passive income at present. People can invest for a certain period and earn money. This article will guide you to explore the top 6 ways to earn passive income in 2024 as below mentioned.

- Crypto Staking

- Crypto Trading

- Crypto Mining

- Crypto Lending

- Yield Farming

- NFTs

1. Crypto Staking

Crypto staking is among the most effective ways of building passive income within a cryptocurrency network. Investors have the possibility of staking their cryptocurrency assets on proof-of-stake networks for a contribution toward the running of those networks in activities involving transaction validation and network security. In return, this commitment is rewarded, usually in the form of additional tokens.

StakingBonus: Your Staking Resource

StakingBonus is a major platform for everyone looking to maximize his or her staking rewards. The website does an excellent job of providing information regarding different staking platforms to the audience for informed decisions.

Key Features of StakingBonus

Detailed Comparisons: Detailed comparisons of various staking platforms based on their rewards and fees.

Educational Resources: Guides and articles regarding staking to further assist website users.

User-Friendly Interface: An intuitively designed layout makes navigation much easier and helps to make better decisions.

Real time analytics: access real time data on staking performance, rewards and market trends to make decisions.

Secure wallet integration: seamlessly connect and stake assets directly from your preferred wallets with top notch security.

How to Sign Up for StakingBonus

- Visit Website: On your browser, open the StakingBonus homepage.

- Create Account: Tap on “Sign Up“.

- Input Details: Key in your e-mail address and click a strong password for your account.

- Confirm Your Email Address: It is done by going to your inbox, looking for a confirmation email, opening it, and clicking on the link to confirm your account.

- Fill Up Your Profile: In case of any extra information about your profile, one needs to go and fill it out after signing into the account.

- Explore: Once you are listed on this official website, you will be given access to various staking options, calculators, and resources

Specificity of StakingBonus

StakingBonus enables crypto investors to find the best options to stake by aggregating various staking options with rewards and risks. It enables users to compare and choose the most suitable plans in a variety of cryptocurrencies. The detailed data of staking returns, lock-up period, and requirements of participation in a network make it easier for the user to make more informed decisions.

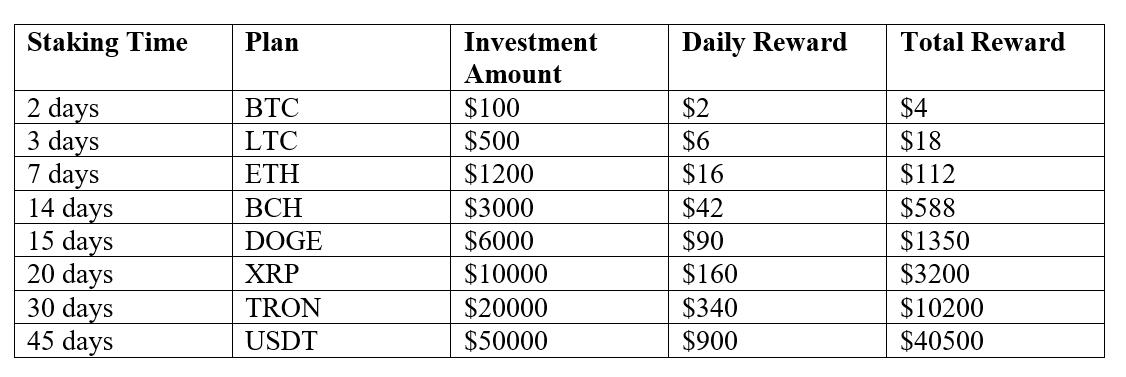

Staking Plans on StakingBonus

At StakingBonus, there are several different staking plans depending on multiple investment strategies. Users can take into consideration several options, offering variable periods of lock-up and amount of minimum stakes along with rewards.

Bitcoin (BTC)

Bitcoin doesn’t use typical staking; it employs a Proof of Work mechanism. However, some platforms will give interest-bearing accounts or BTC lending services whereby you lend your BTC to borrowers for passive returns.

Litecoin (LTC)

As with Bitcoin, there is no form of traditional staking with Litecoin, since it relies on a proof-of-work system. However, users can still lend LTC through platforms that pay interest on deposited assets. Deposit lending facilities allow LTC holders to receive passive rewards by lending their assets.

Ethereum (ETH)

With the transition of Ethereum 2.0 into Proof of Stake, you can stake ETH and get a reward for contributing to the network’s transaction validation process. Typically, staking with ETH requires at least 32 ETH, but some platforms provide pooled staking options where you can go lower.

Bitcoin Cash (BCH)

Bitcoin Cash is yet another PoW coin that does not natively support staking. Much like BTC and LTC, however, BCH holders may achieve passivity via lending services or interest-earning savings accounts; these services allow users to grow their BCH holding over time.

Dogecoin (DOGE)

Dogecoin also uses a PoW consensus and cannot be staked traditionally. However, many platforms offer DOGE lending or interest-bearing accounts, whereby any DOGE holder can earn passively. Lending programs give you the ability to grow your DOGE without trading.

Ripple (XRP)

Ripple runs on a different consensus, and does not depend on any sort of PoS; therefore, it cannot be staked. However, there are interest-bearing programs for XRP available on some platforms that allow users to lend their XRP or hold it in some savings account to accrue passive interest.

TRON (TRX)

It uses a DPoS system where TRX holders can stake their tokens and vote for Super Representatives. When the users stake TRX, they are more actively contributing to the security of the network and receive staking rewards in return. Thus, a low Entrance Barrier TRX Staking is an effortless way of passive income generation.

Tether

USDT is a stablecoin and doesn’t have the function of PoS. Still, many platforms offer interest-bearing accounts or lending services against USDT, thus allowing a stable way of passive income.

2. Crypto Trading

Crypto trading is one of the more well-known methods of building wealth in the digital asset space. Traders actively buy and sell with the aim of capitalizing on market volatility and price fluctuation.

3. Crypto Mining

Crypto mining remains among the surest ways to earn money with cryptocurrencies. The process entailed is validating transactions and securing the network by solving complex mathematical problems. Miners will be rewarded with freshly minted coins as they engage in this area, making mining a great opportunity for investors that are technologically savvy.

4. Crypto Lending

Crypto-lending is fast becoming an attractive form of passive returns for sitting or idle cryptocurrency. Crypto lending platforms facilitate a process in which users can lend their cryptocurrencies against borrowers who pay interest on such loans.

5. Yield Farming

Yield farming has gained momentum among investors who are eager to generate passive income streams within the DeFi ecosystem. It includes providing liquidity to some decentralized exchange or lending protocol, where users are paid interest or rewarded in the form of more tokens.

6. NFTs

NFTs have taken the digital world by storm and offer creators and collectors new ways to make money from digital assets. Buying, selling, and trading in NFTs can yield huge profits. NFTs may denote several digital items, ranging from art to music, even to virtual real estate.

Conclusion

In 2024, there are various ways of building wealth through cryptocurrencies. Each of these methods-staking, trading, mining, lending, yield farming, and NFTs-comprises individual opportunities and challenges. Leveraging different platforms, such as StakingBonus, and educating oneself about the many strategies, allows investors to make more effective decisions and increase their chances for financial success in the ever-changing world of digital assets.

Disclaimer: This is a sponsored press release, and is for informational purposes only. It does not reflect the views of CryptoTotem, nor is it intended to be used as legal, tax, investment, or financial advice. The author or the publication does not hold any responsibility, directly, or indirectly, for any damage or loss caused or alleged to be caused by or connected with the use of or reliance on any content, goods or services mentioned in this article. Readers should conduct their own research before taking any actions related to this company.