Ethereum is finally making its mark as it steps into the financial mainstream. Spot Ether exchange-traded funds (ETFs) began trading on Tuesday, giving investors a new way to access cryptocurrency without buying it directly.

Impact on the Financial Market

The introduction of Ethereum ETFs has already made a significant impact on the financial market. These ETFs have opened the door for more institutional investors to access Ethereum, likely increasing liquidity and potentially driving up its price. On the first day alone, the investment vehicles generated $1 billion in trading volume, reflecting the value exchanged between all traders. Additionally, the regulatory approval of these ETFs could bolster trust in cryptocurrencies.

Comparison with Bitcoin ETF

Similarities:

- Structure: Both ETFs track the price of their respective cryptocurrency.

- Investment object: Investors can access assets without needing to store them.

- Liquidity: Both ETFs offer liquidity, allowing traders to quickly enter and exit positions.

Differences:

- Technological base: Ethereum supports smart contracts and decentralized applications, whereas Bitcoin is, in fact, digital gold.

- Regulatory hurdles: Bitcoin ETFs faced a longer approval process with the SEC compared to Ethereum ETFs.

- Usage methods: Ethereum is used in DeFi, NFT, and other applications, which Bitcoin does not support as extensively.

Regulatory Perspective

The SEC has traditionally been cautious about cryptocurrency ETFs. The approval process involved:

- Financial statements and compliance with reporting standards.

- Ensuring against market manipulation and providing evidence of liquidity.

- Discussions with other regulators and analyzing potential risks for investors.

Popularity Among Investors

ETFs attract investors due to their convenience:

- Accessibility: Easy to buy and sell on stock markets.

- Diversification: Ability to invest in different assets from a single position.

- Tax advantages: Some jurisdictions offer tax incentives for ETFs.

Popularity of Ethereum ETFs

The anticipation and launch of the Ethereum ETFs showed its high popularity, sometimes even surpassing direct trading of the cryptocurrency. Reasons for this include:

- Institutional trust: Higher trust levels among institutional investors in ETFs.

- Security: Avoids the complexities associated with storing cryptocurrencies.

- Clear investment rules: ETFs are subject to strict regulations.

Staking and the ETFs

Staking involves retaining and supporting the operation of Ethereum-based networks. However, many funds avoid staking in their applications to minimize risks and ensure maximum liquidity for investors.

Expected Fees and Their Impact

Ethereum ETF fees are expected to range from 0.1% to 1.5% of assets under management (AUM). These fees may affect the attractiveness of ETFs compared to directly buying cryptocurrencies, especially given Ethereum’s potential growth.

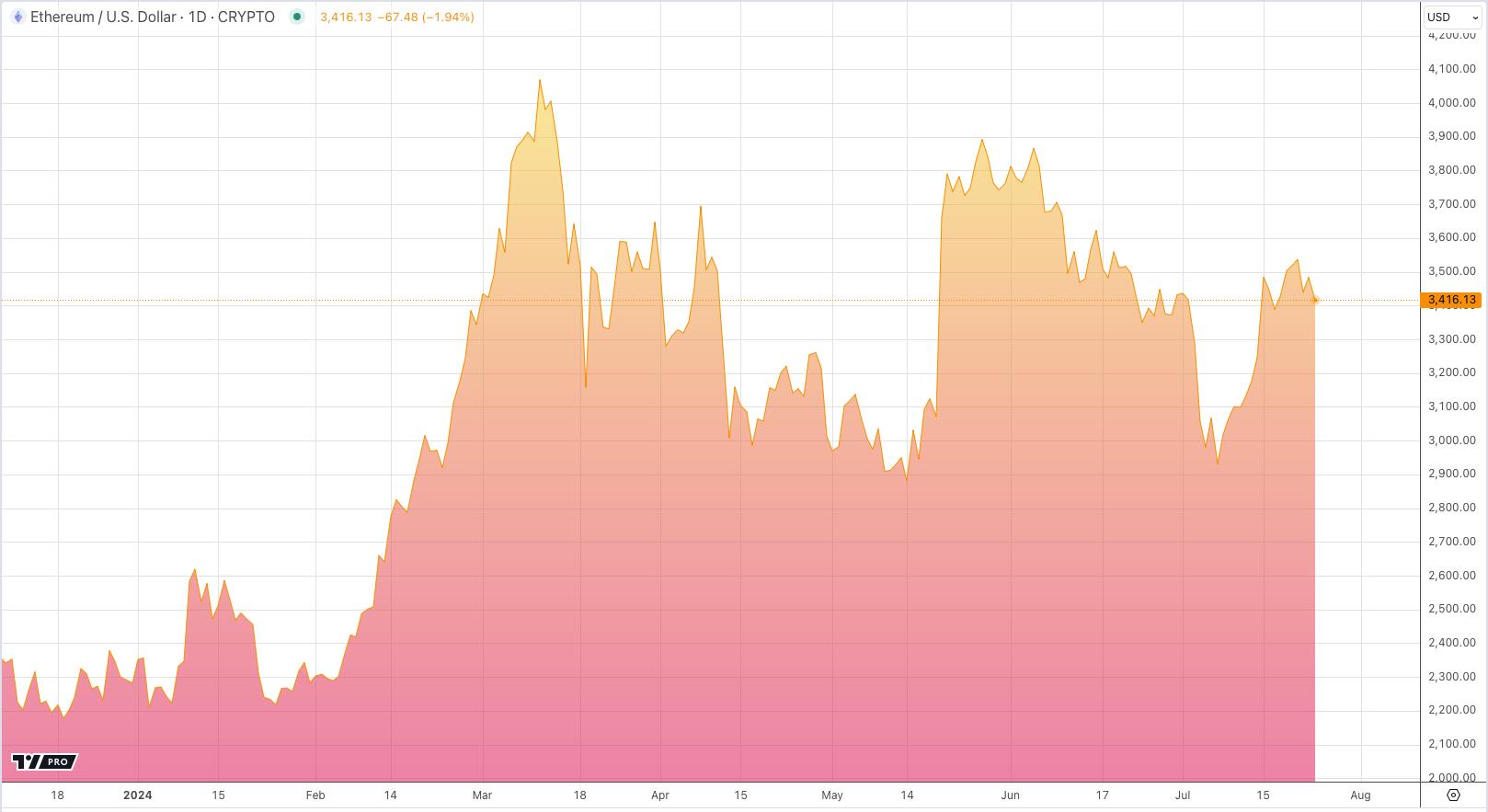

Impact on the Ethereum Exchange Rate and Ecosystem

The launch of the Ethereum ETFs has significantly increased activity and interest in Ethereum and its ecosystem. This can positively impact the Ethereum exchange rate and all coins and projects based on it, including Layer-2 solutions. Increased institutional investment may drive additional demand for Ethereum, contributing to higher prices for digital assets.

Thus, the Ethereum ETFs open up new horizons for investors and can significantly strengthen Ethereum’s position in the financial world.

Disclaimer: The views expressed in this article are those of the author and may not reflect the views of the CryptoTotem team. This article is for informational purposes only and is not intended to be used as legal, tax, investment or financial advice. The author or the publication does not hold any responsibility, directly, or indirectly, for any damage or loss caused or alleged to be caused by or connected with the use of or reliance on any content, goods or services mentioned in this article. Readers should do their own research before taking any action on this matter.