Today we’re talking about how to invest money in your 20s. The 20s are probably the best time in your life to live it up. You just graduated from college and got a full time job. You don’t have that much responsibility compared to how much income you’re bringing in. Now you have much more freedom. This is like college on steroids almost. However, If you do things right and develop some good habits during your 20s, you’re going to be able to set yourself up financially for life.

In this post I’m going to teach you how to invest money in your 20s. I want to break this down into 7 easy steps for you to follow.

1. Take advantage of Compound interest

When you’re in your 20s, you probably think that you have so much time or so many decades to be able to save. Why do you need to start now? Now you have the power of time on your side. You have something called compound interest which Albert Einstein dubbed the eighth wonder of the world.

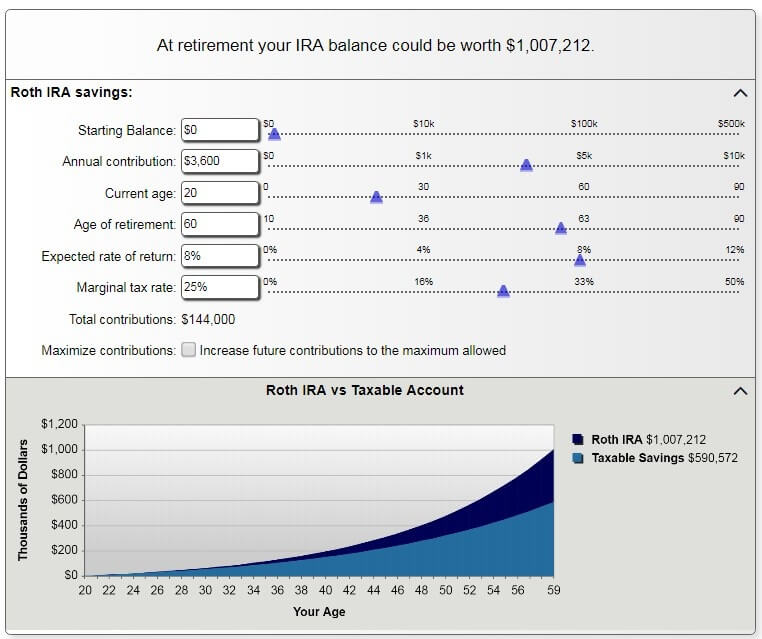

Here’s a great example. Let’s say you invest 300 dollars per month starting at age 20 and don’t stop until you’re 60 years old. If you managed 8% return during that time, you would have more than 1 million dollars in that account alone.

Now let’s say you waited until you were 30 to get started. By the time you reach 60 years old, you would only have 440 000 dollars in your account. Those first 10 years, you missed out on, would cost you more than 550 000 dollars in returns. Even though you only skipped 36 grands and 10 years of deposits.

The way compound interest works is when the interest you earn on your savings or investments begins to compound on itself. Think of it like a wave or a Tsunami getting bigger. The water builds on itself until it gets huge, or until you retire, or until it destroys a small city of the coast of Thailand.

2. Realize that Money is a Tool

Use it as a tool to create the lifestyle you want, instead of using it as something to pay your bills and help you get to the next week or the next paycheck. Trading time for money and a job is probably not the way that most of us want to live our lives.

While you’re in your 20s and don’t have so much responsibility, you shall think about using your money and have that work for you. You need to create assets that create money for you every month or every week. For example, take a look at a dividend stock or a rental property. If you want to use a dividend stock, you can take a 3% yield and multiply that by 100 000 dollars over the course of saving up. That’s going to net you 3000 dollars throughout the year. That’s extra 3000 dollars that you just created out of doing nothing, literally passive income. If you get to the point where you earn a million dollars and put them into that over the course of time, you’re going to be getting back 30 000 dollars a year. That’s actually a full time income for some people. You haven’t done anything but invest. Your money is working for you. Realize that money is a tool.

3% Dividend Yield

- $10k = $300/yr

- $100k = $3,000/yr

- $1M = $30,000/yr

3. Ramp up your savings as you age

Although you don’t have that much responsibility in your 20s, you’re trying to save up for a lot of things whether it is a travel, a house or a car. You may even have a newborn on the way. You need to be able to pay for all those things and still save. You want to live your life and have a good balance as well financially. Many people recommend to start with 1 % a year when you’re 20 years old. If you save 1 % of your income when you’re 20, by the time you’re 30 years old, you’re saving 30% of your income. That number seems to be too low. The more you save earlier, the more it’s going to compound over time. I would recommend starting saving your gross salary or gross income at 5 % and then increasing that by 1% per year. By the time you get into your 30s, you’re going to be at 15% of savings. This isn’t going to help you in the long run. By the time you reach your 30s or 40s, you may be getting pay raises or bonuses. You’re not going to miss that lifestyle, and you’re still going to be saving up that money. And again you’re going to be living the same way as you already are. You’re not sacrificing lifestyle for savings.

- 20 yrs old = 5%

- 21 yrs old = 6%

- 22 yrs old = 7%

- 23 yrs old = 8%

- 24 yrs old = 9%

- 25 yrs old = 10%

- 26 yrs old = 11%

- 27 yrs old = 12%

- 28 yrs old = 13%

- 29 yrs old = 14%

- 30 yrs old = 15%

4. Ignore all the Jones’es & the Kardashians in your life

Ignore all pro athletes, rappers, and all that stuff. Everyone likes to live like them because they see it on TV. However, at the end of the day there’s no substance to such lifestyle. Material things are most likely not going to keep you happy. They’re just going to be a bandaid over a deeper issue. You need to enjoy things like family, health, time. Those are things that you can’t pay for. Stop trying to keep up with the Jones’es because the Jones’es are broke. Everybody has different personalities, tastes, risk tolerance and so on. You need to account for that when it comes to your personal lifestyle. That’s why it’s called Personal Finance.

5. Invest in yourself

Investing in yourself whether through books or education is probably the number one investment that you can make. My mom always said: “They can take away material things from you, but they can’t take away what’s in your head”. Read as many books as you can when it comes to finance, self development, things like that. Forget about the cheesy books that have no substance. They’re all just filler that make you feel good. You need to get books that have actionable plans. The books that I recommend are “Think and Grow Rich” by Napoleon Hill, “The Intelligent Investor” by Benjamin Graham and “The Millionaire Next Door” by Thomas Jay Stanley. These are 3 books that I’ve read early on in my life and they’ve helped me greatly.

6. Automate your investments and have them work for you

That way when you pay yourself first, you don’t even see that money is leaving your account. The way I set up my finances is the following way: I have a Capital One account online and also my own checking account online. I get paid through work, or investments, or income into my checking account. Every week I have certain funds that go into the Capital One account. I have a travel fund, a retirement fund, a house fund, an emergency fund, and a car fund. When you start paying attention to these over time, you log back into Capital One, you will be surprised to find X amount of dollars saved in all these different funds. For example, I plan on going to Europe later this year in 2018, and I actually have money saved up in my travel fund without even having to think about it. All I have to do is transfer that money that I’ve been saving up throughout the year. It goes into my checking account. Everything is paid for and I don’t even miss that money. The point is that you don’t have the opportunity to spend it if it’s not in front of you. That way you’ll never miss it.

- Travel Fund

- Retirement Fund

- House Fund

- Emergency Fund

- Car Fund

7. Set up a retirement account

Please set up a 401k, set setup a Roth IRA. These are not negotiable or optional. You need to absolutely do this. You need to take advantage of a 401k that your employer matches if they match. I would recommend at the minimum contribute whatever the employer matches. If they match 4% at 100%, contribute at least 4%. Also open up a Roth IRA. All you have to do is put away 300 to 400 dollars per month, and you can be a millionaire by the time you retire. That is 100% guaranteed. I don’t want to make guarantees as there could be world catastrophe, famine and all that stuff. But that’s most likely not going to happen. Please max out your Roth IRA and at least contribute the minimum to your 401K. If you want to invest money in your 20s, these are the best 7 ways to do so.

I recommend doing this because it will set up a strong foundation for the rest of your life, and this way you can provide for the rest of your family tree, whether it’s your parents, or it’s your future family, or it’s your significant other. This is a good blueprint to a solid financial foundation.

Thank you so much and have a prosperous day.

by Marco — WhiteBoard finance

Disclaimer: The views expressed in this article are those of the author and may not reflect the views of the CryptoTotem team. This article is for informational purposes only and is not intended to be used as legal, tax, investment or financial advice. The author or the publication does not hold any responsibility, directly, or indirectly, for any damage or loss caused or alleged to be caused by or connected with the use of or reliance on any content, goods or services mentioned in this article. Readers should do their own research before taking any action on this matter.

One Response

Okay I’m coneincvd. Let’s put it to action.