Today we’re talking about the single most important metric in your personal financial life that is called net worth. Let’s get into it.

What is net worth?

Net worth is simply how much you own versus how much you owe. Otherwise, it’s known as assets minus liabilities. Tracking your net worth is important because it’s similar to tracking a diet. You want to look at how many calories you have coming in versus how many calories are coming out. It’s the same way with tracking your net worth. You’re counting the dollars that are coming in due to buying new assets minus the dollars that are going out due to liabilities. Tracking is important because it drives future financial decisions to hopefully increase your net worth, meaning that you’re increasing your assets and decreasing your liabilities.

How do you calculate net worth?

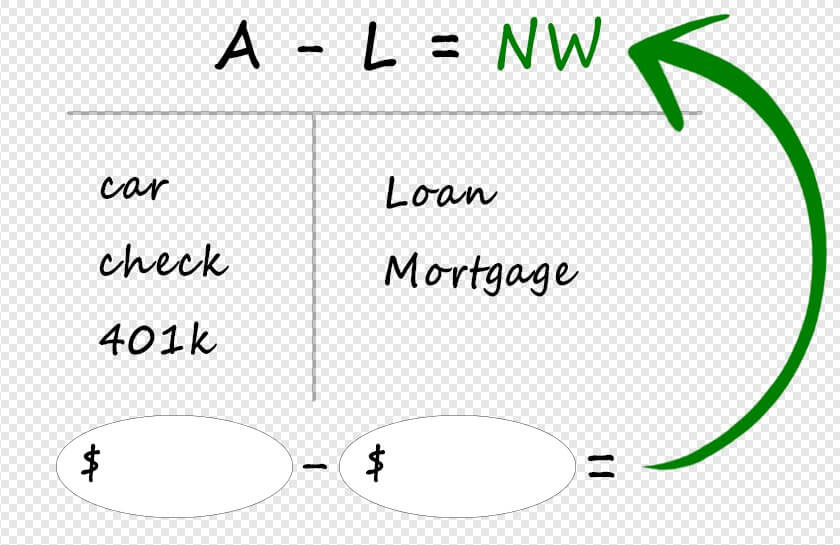

It’s simply your assets minus your liabilities. What you do is just make a column full of assets. They could be your car, any money in your checking account or in a 401k, etc. Anything that you own and don’t owe is considered an asset. You also have liabilities. These can be loans such as student loan, personal loan, or mortgage. If you owe money on your home, that is not an asset, that is a liability because you’re paying off a mortgage every month. All you do is add up all your assets, add up all your liabilities, subtract the two, and that number is your net worth. It’s a very simple equation, but it sounds intimidating, if you’ve never tried to find out your net worth before. I hope this makes it a little bit easier.

ASSETS – LIABILITIES = NET WORTH

What if your net worth is negative?

There’s nothing to worry about depending on what stage of life you’ re in. Life happens to everybody. A good example would be if you’re young in life. Let’s say you’re just graduated and got your new job. You may not have had enough time to accumulate enough money or assets versus your student loans that you may have. You could be in a negative net worth. If you’re in middle of life, you could potentially have a new house or a big mortgage. Even though you own your cars outright and have a lot of assets, the big mortgage could be weighing negatively on the liability side, putting you in the red. You can also simply be an over-borrower. This is someone who earns sufficient income but just keeps spending and spending, and now he is in the red and has a negative net worth.

The final point that I want to touch on is how often you should calculate your net worth. Some people like to do it monthly. Some people that are very anal like to do it weekly. I stick to a quarterly schedule. This gives me three months to actually see if there’s any big adjustments: whether I took out a loan or I paid off a large loan. Typically, things don’t happen in my life that quickly. I stick to a quarterly schedule every three months. It keeps it a lot more organized. It’s also a lot easier to manage in the long run.

In conclusion, I just want to say that tracking your net worth shouldn’t be used to keep up with the Jones’es or to compare yourself with other people. That is probably the worst way to use your net worth calculations. Finding out your net worth is simply like keeping track of your diet. Again it’s like calories in versus calories out. You want to make sure that you get that personal net worth nice and fat? That way you can survive any cold winters. I just came up with that on the spot, and that’s pretty freaking good.

If you have found something useful in the post, please, answer the question of the day below.

Are you happy with your current net worth? Are you indifferent? or Are you unhappy with it? If so, what are you going to do to change that?

More articles:

Thank you and have a prosperous day.

by Marco — WhiteBoard finance

Disclaimer: The views expressed in this article are those of the author and may not reflect the views of the CryptoTotem team. This article is for informational purposes only and is not intended to be used as legal, tax, investment or financial advice. The author or the publication does not hold any responsibility, directly, or indirectly, for any damage or loss caused or alleged to be caused by or connected with the use of or reliance on any content, goods or services mentioned in this article. Readers should do their own research before taking any action on this matter.