|

AscendEX (BitMax) Review

Bank transfer

Credit Card

Cryptocurrency

Withdrawal fee: 0.0005 BTC Taker fee: 0.20% Maker fee: 0.20% |

| Spot OTC Custodial CEX Derivatives |

Margin trading |

Yes |

Launched |

2018 |

24h Trading Volume |

$1,330,973,581 |

Coins |

98 |

Trading pairs |

100 |

Main location |

Singapore |

Is centralized? |

Yes |

API |

Yes |

KYC |

Yes |

2FA |

Yes |

AscendEX (formerly BitMax) is a global cryptocurrency financial platform with a comprehensive product suite including spot, margin, and futures trading, wallet services, and staking support for over 150 blockchain projects such as Bitcoin, Ether, and XRP. Launched in 2018 with headquarters in Singapore, AscendEX services over 1 million retail and institutional clients from 200+ countries across Europe, Asia, the Middle East and America with a highly liquid trading platform and secure custody solutions.

AscendEX has emerged as a leading platform by ROI on its “initial exchange offerings” by supporting some of the industry’s most innovative projects from the DeFi ecosystem such as Thorchain, xDai Stake, and Serum. AscendEX users receive exclusive access to token airdrops and the ability to purchase tokens at the earliest possible stage.

George Cao, the CEO, and Ariel Ling [LinkedIn] (COO) co-founded the company with a core management team that have worked across large traditional financial institutions, technology and crypto companies.

AscendEX Fees

Trading Fees

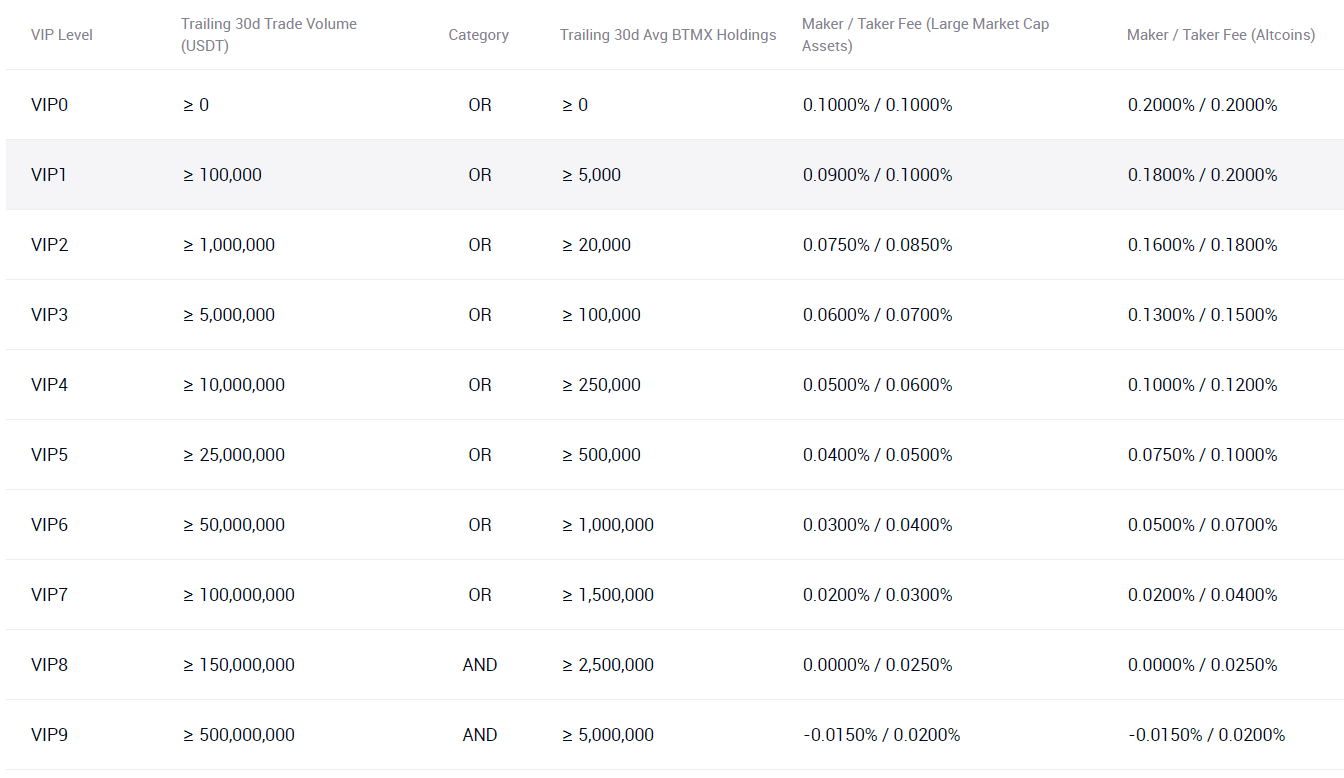

AscendEX’s tiered trading fees are calculated based on a user’s daily trading volume in USDT or the trailing 30-day average of ASD token holdings. For example, each tier has a different set of maker and taker fees depending on if you’re trading in large-cap coins or altcoins, as seen below. To achieve a certain level, for example, the VIP1 tier requires at least 100,000 USDT in trading volume over a 30-day period, and the VIP9 tier requires over 500,000,000 USDT in volume.

Withdrawal fees

In regards to fees for withdrawing your crypto, AscendEX remains competitive amongst many exchanges. For example, you will pay 0.0005 BTC for withdrawing Bitcoin, 0.01 ETH for withdrawing Ethereum, 1 ADA for withdrawing Cardano, etc.

Trading View

Spot Trading

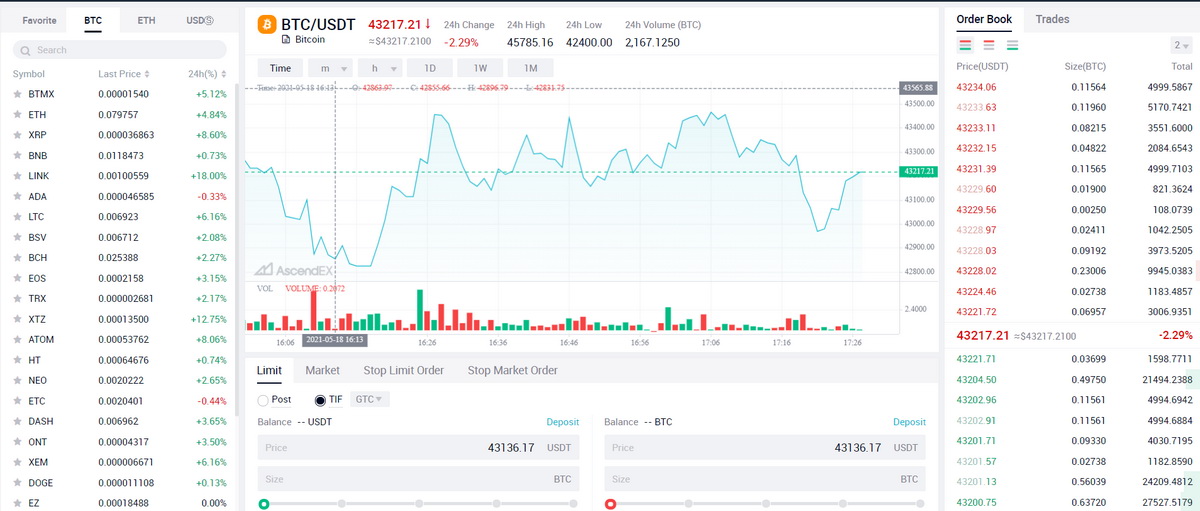

Spot trading is simple and can be executed with a number of token pairings. Token prices are displayed at the top, token pairings are listed on the left, and order book information is on the right-hand side.

Total volume is conveniently available at the bottom of the price chart, as opposed to having to look for this information elsewhere.

Margin Trading

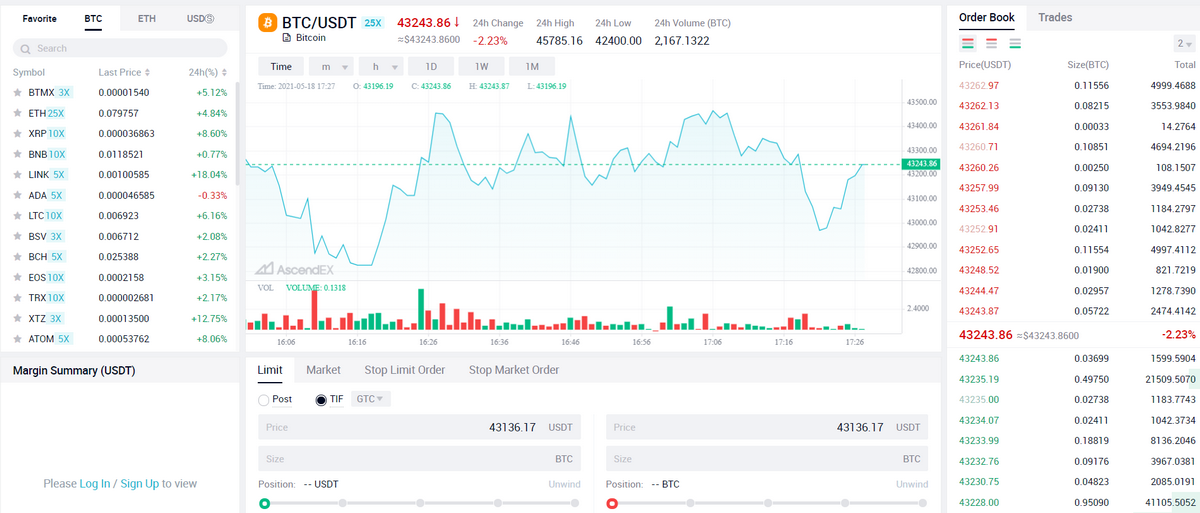

AscendEX exchange offers margin trading to its customers for Bitcoin and various different altcoins. They allow for up to 25x leverage, and a list of some of the cryptos they allow for margin trading can be found in the image below. When you open an AscendEX account, your margin account is automatically set up, and no interest is charged if you repay within 8 hours.

Futures Trading

The futures contracts that AscendEX offers are called “perpetual contracts,” which are available for 15 trading pairs with collateral in BTC, ETH, USDT, USDC, or PAX. AscendEX perpetual contracts do not expire, so you can hold longs or shorts for any period of time you desire as long as you have enough margin. AscendEX’s trading platform allows up to 100x leverage for futures trading, which is some of the highest in the industry.

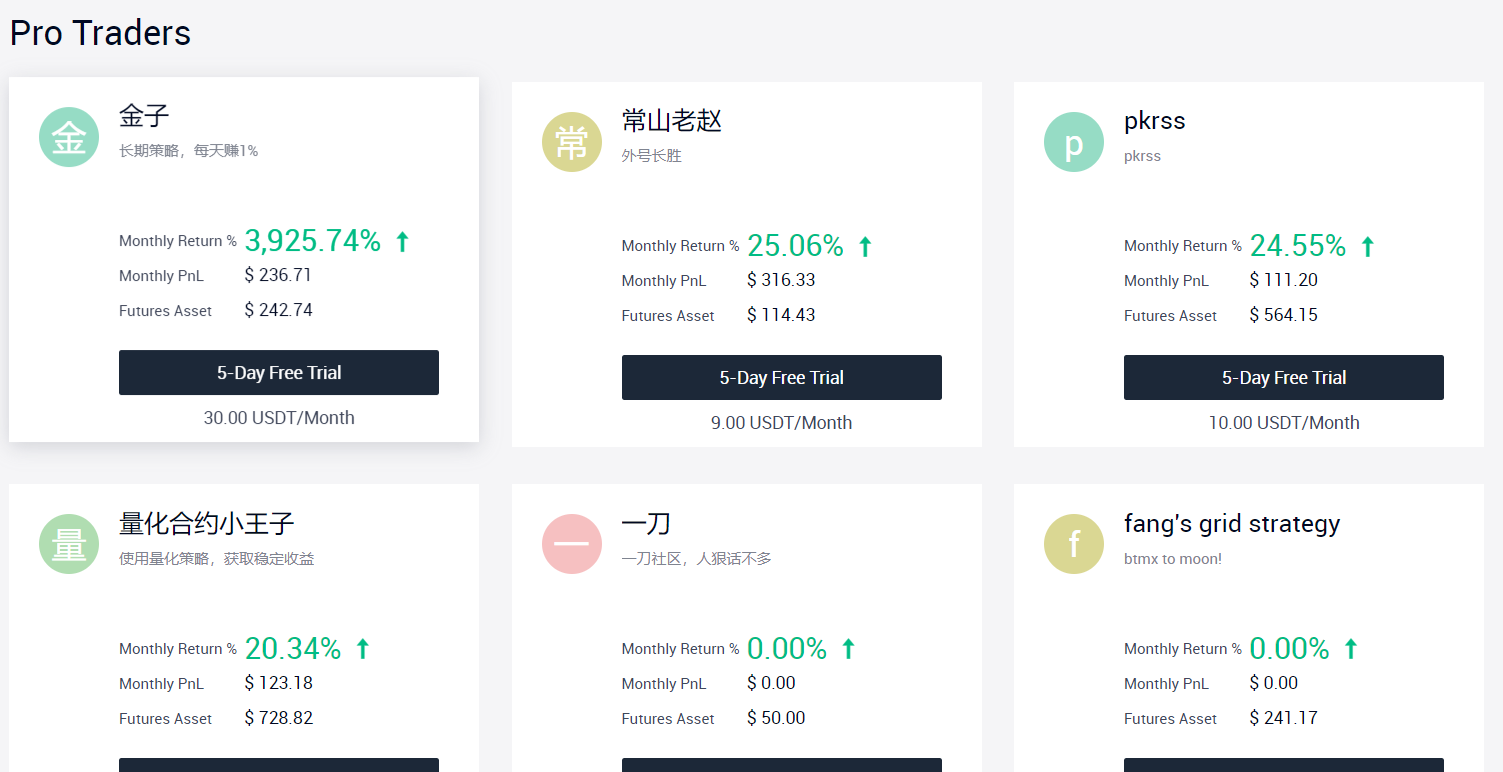

Copy Trading

This is an innovative feature on AscendEX allowing users to purchase a subscription to some of the top traders on the exchange and then mimic/copy their trades. Users’ accounts will follow the pro trader’s order instructions, meaning trades will be executed identically to theirs.

Copy trading is ideal for users who may lack confidence in day trading and want to follow someone more experienced to capitalize on potential gains. All trader information can be seen on the webpage, where you can view their monthly return, monthly profit/loss, futures assets, and the price to subscribe.

AscendEX API

AscendEX has upgraded their backend system to support AscendEX Pro APIs, which is their latest release of APIs that provides users access automatically. This upgrade improves upon the older versions’ speed and stability. There are now both synchronized and unsynchronized API calls available when placing or cancelling orders; synchronized API calls will get you the order result in one API call, and asynchronized API calls will execute the order with the least delay.

Additional features include more detailed error messages, simplified API schemas to track the entire order life from start to finish with one identifier, and more.

Supported Countries and Cryptos

AscendEX’s digital asset trading platform offers support for most countries across the globe – however, there are a few exceptions. Countries that are not supported are the United States, Algeria, The Balkans, Bangladesh, Belarus, Bolivia, Burma (Myanmar), Cambodia, Côte D’Ivoire, Cuba, Democratic Republic of the Congo, Ecuador, Iran, Iraq, Liberia, Nepal, North Korea, Sudan, Syria, and Zimbabwe.

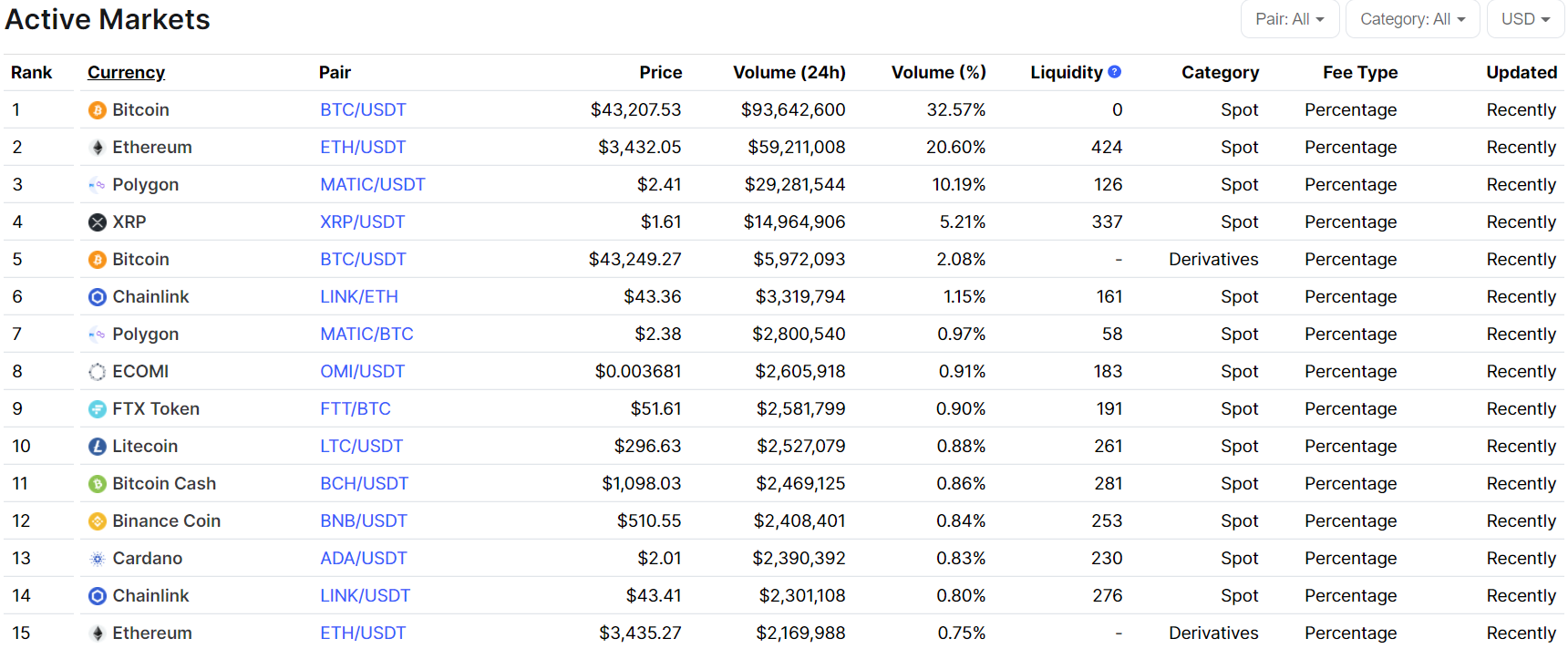

They offer access to over 150 different trading pairs and margin trading for over 50 tokens, ranging from the largest market cap coins to some of the lesser-known altcoins, providing a wide variety of choices and pairings across the board.

ASD Token and Ecosystem

ASD (Formerly BTMX) is the native utility token for the AscendEX trading platform, and token holders can receive many rewards and services. Users have the option to stake their ASD tokens for lucrative APYs, receive discounts on trading fees, use them in investment products to earn daily rewards, use them to increase their chance of winning an auction and to purchase point cards for reduced margin interest fees.

Holders are also granted with opportunities to take advantage of ASD investment products, auctions, price predictions, and exclusive token private sale releases. For example, users can multiply their airdrop rewards and investment profit with specific cards.

Deposit and Withdrawal Methods

There are multiple ways you can deposit assets onto AscendEX. The first is by crypto deposit, where you can navigate to your online wallet, select the token you wish to receive, copy the deposit address by the token on AscendEX Deposit page, paste it on your online wallet, and then send the token to that AscendEX deposit address.

If you want to withdraw your tokens, navigate to the Withdraw page on AscendEX and paste the deposit address of the external wallet you are trying to send to, and click “Confirm” to withdraw the tokens.

Users can also purchase cryptocurrencies with fiat via a credit card or debit card payment (Visa/Mastercard) in USD, EUR, GBP, UAH, RUB, JPY, and TRY. Supported assets for purchase are BTC, ETH, USDT, BCH, TRX, EGLD, BAT, and ALGO. You can also make deposits and withdrawals from and to your bank account via those card payment processes.

Other Features and Services

Over-the-Counter (OTC) Trading Solution

Prime Trust is a US regulated trust and custodian supporting AscendEX, which helps provide an OTC trading solution to AscendEX’s customers. The supported assets are Bitcoin, Ethereum, and Tether (USDT), and a minimum of $100,000 is required for a transaction.

ASD Investment Multiple Card

The ASD Investment Multiple Card is available to users as an additional incentive, which can be purchased with the ASD token. If you have 1 multiple card, up to 10,000 ASD in your account will be multiplied by 5 when your portion of the platform distribution pool is calculated – in other words, you can potentially make a 5x return on your investment with a cap of 10,000 ASD if you purchase one of these cards.

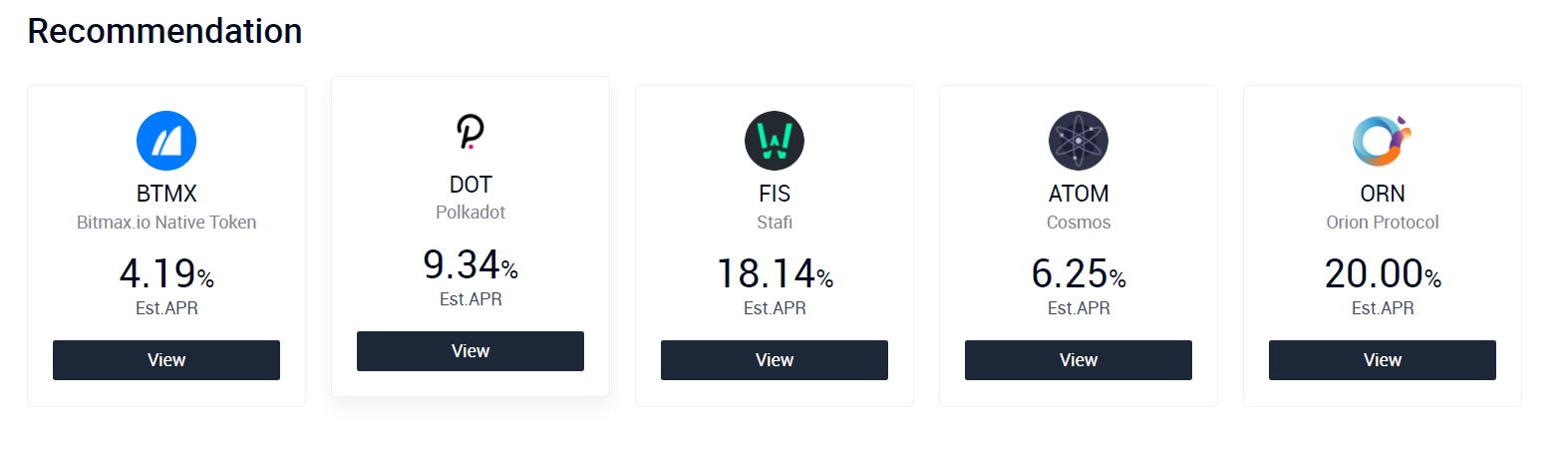

Staking

Users can earn rewards from staking their token. Earned rewards are automatically reinvested in order to create a compounding return to increase the overall ROI – this is optional and can be switched on/off as desired. Moreover, the platform offers a very unique instant unbonding feature that allows for the improved liquidity management of staked tokens, even when tokens are being delegated to a network with a long bonding period. Also, you can use staked token as collateral for margin trading.

DeFi Yield Farming

Users can lock up tokens to earn yield farming rewards on AscendEX. They offer decentralized liquidity pools and lending/borrowing options – yield optimization vaults and derivatives protocols are not yet available but coming soon. The benefits of yield farming on their platform are that there are no gas fees and that the team takes care of all backend integration to make the process as simple as possible with a “one-click” function.

BitTreasure

BitTreasure is a financial product that allows users to invest tokens for a high rate of return. The total rate of return is dependent upon the token you choose to invest and the investment term period (30, 90, or 180-day terms are available).

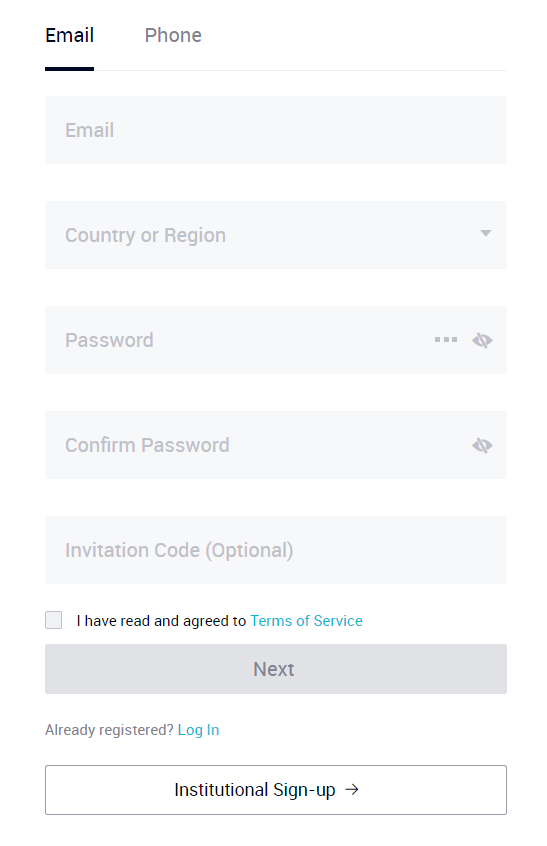

How to use BitMax Exchange

To create an account, you can go to their website and click “sign up” in the upper right-hand corner, which will then give them two options: verifying by email or phone number. Users will enter their details and then verify their phone number or email address by entering the security code sent to their device.

Users will also need to provide verification of a government-issued ID, in the form of an ID card or passport. Users will also be required to take a selfie with a piece of paper in your hand to confirm it’s really you, which should contain the account email address, AscendEX website, and the current date.

Security

There are several security options on AscendEX that users can utilize to keep their account safe. The first is a password, which users will need to create an account; it is important to choose a unique password with a variety of different numbers and characters.

Enabling two-factor authentication with Google Authenticator adds an extra layer of security that can help keep users’ accounts from being accessed. Users need to navigate to Security Settings page to enable 2FA, and it will prompt them to scan the barcode or enter the encryption key. Once this has been enabled, whenever a user logs in to AscendEX, they will need to enter the 6-digit code, which is only available on the Google Authenticator app.

AscendEX has developed a comprehensive set of electronic, administrative and procedural measures to make sure all user data remains as safe as possible. It also holds a large portion of its digital assets in cold storage – some are kept in a hot wallet to support the liquidity of its trading ecosystem.

Conclusion

The advantage of using AscendEX is that with a multitude of its services, it is essentially a “one-stop-shop” for digital assets from basic trading to advanced investing, staking, margin trading, and more. It also provides users with options to earn substantial rewards through ASD, its own platform token. While their trading fees are fairly competitive, they are not the lowest available compared to some of other exchanges. Additionally, they do not provide insurance, so your funds might be at risk – that being said, most exchanges do not provide guaranteed insurance on your assets.

Give AscendEX a try for yourself and see what they can offer! Below are our pros and cons:

Pros

- A variety of different services and leverage to choose from

- Large amount of digital assets available for trading

- A number of exclusive alt-coin listings

- Easy-to-use interface

- Fluid mobile app for on-the-go convenience

- Plenty of attractive staking and yield farming options to earn more off your crypto

Cons

- Although they offer lots of different options, it can be a bit overwhelming – there are too many choices

- Lack of variety when it comes to stablecoin pairings